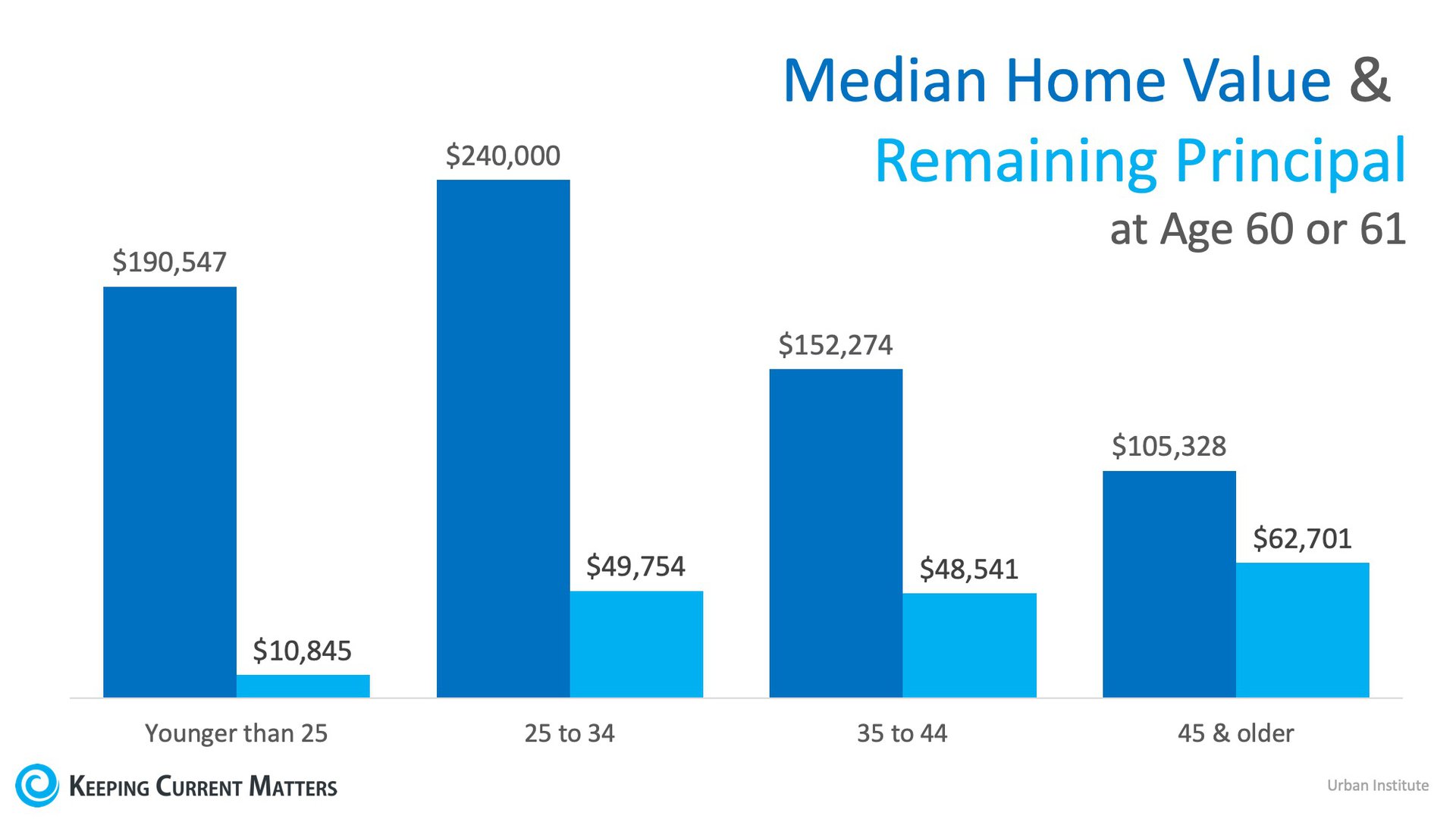

Homeowners who purchase their homes before the age of 35 are better prepared for retirement at age 60, according to a new Urban Institute study. The organization surveyed adults who turned 60 or 61 between 2003 and 2015 for their data set.

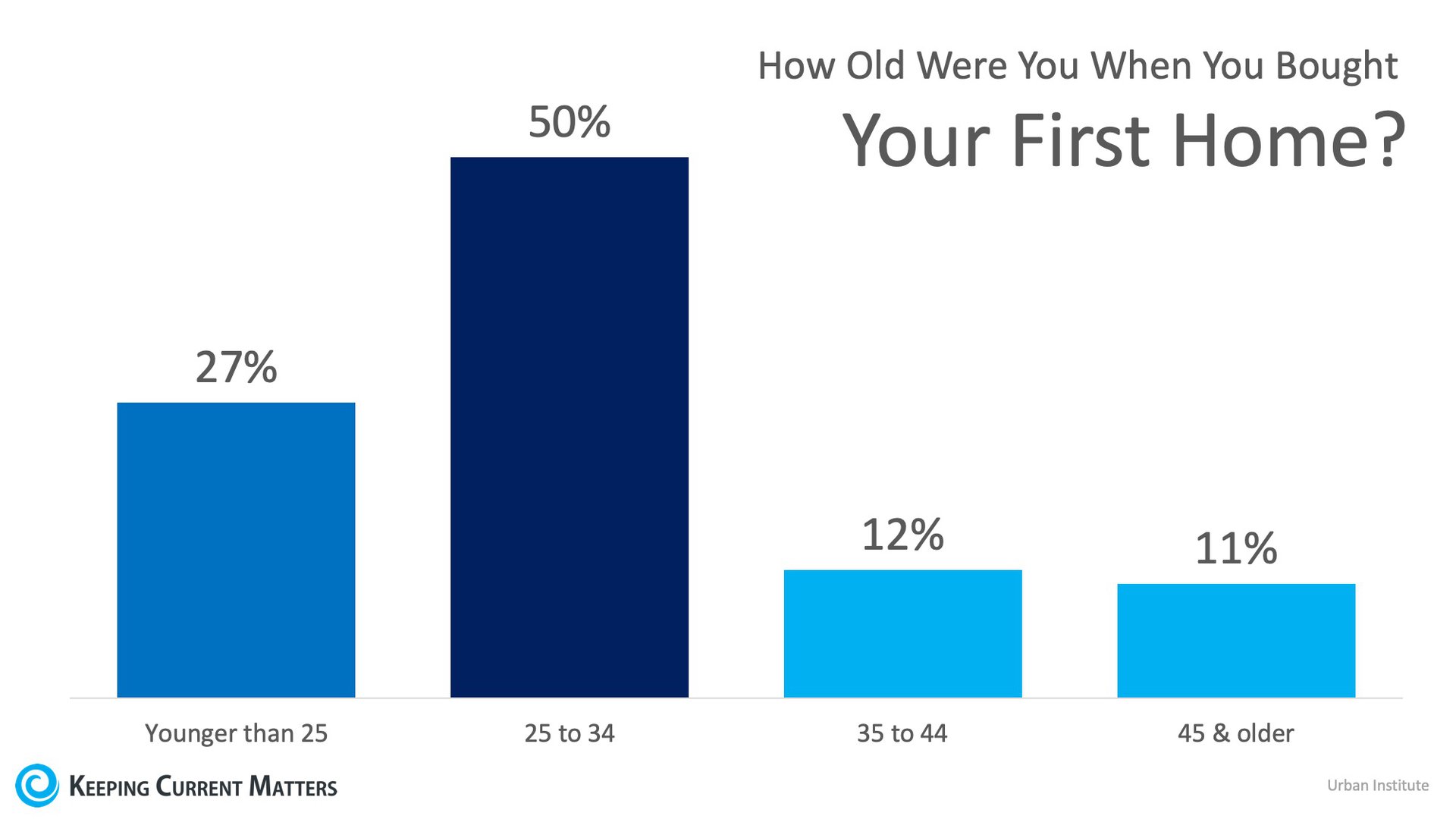

The full breakdown is in the chart below: The study goes on to show the impact of purchasing a home at an early age. Those who purchased their first homes when they were younger than 25 had an average of $10,000 left on their mortgage at age 60. The 50% of buyers who purchased in their mid-twenties and early-30s had close to $50,000 left, but traditionally had purchased more expensive homes. Many housing experts are concerned that the homeownership rate amongst millennials, those 18-34, is much lower than previous generations in the same age range. The study results gave a great reason why this generation should consider buying instead of signing a renewal on their lease:

Bottom LineIf you are one of the many young people debating whether buying a home this year is right for you, sit with a local real estate professional who can help.

Nicole Folks

17400 Northwoods Blvd Ste B 530.386.7538 NK@TahoeBre.com CalDRE#: 01757659

Real estate agents affiliated with Coldwell Banker Residential Brokerage are independent contractor sales associated, not employees. © 2019 Coldwell Banker Residential Brokerage. All Rights Reserved. Coldwell Banker Residential Brokerage fully supports the principles of the Fair Housing Act and the Equal Opportunity Act. Owned by a subsidiary of NRT LLC. Coldwell Banker and the Coldwell Banker Logo are registered service marks owned by Coldwell Banker Real Estate LLC. |

Key to Building Wealth

Buying a Home Young is the Key to Building Wealth

Leave a Reply